Some Known Incorrect Statements About Feie Calculator

Table of ContentsSome Known Facts About Feie Calculator.The smart Trick of Feie Calculator That Nobody is Talking About10 Simple Techniques For Feie CalculatorSome Known Details About Feie Calculator The Greatest Guide To Feie Calculator

He sold his United state home to develop his intent to live abroad permanently and used for a Mexican residency visa with his partner to assist fulfill the Bona Fide Residency Examination. Furthermore, Neil secured a long-lasting residential property lease in Mexico, with strategies to at some point purchase a home. "I currently have a six-month lease on a home in Mexico that I can prolong one more 6 months, with the intention to purchase a home down there." However, Neil explains that acquiring building abroad can be testing without very first experiencing the area."We'll definitely be beyond that. Also if we come back to the United States for physician's visits or company phone calls, I question we'll invest greater than thirty day in the United States in any type of provided 12-month period." Neil emphasizes the relevance of rigorous monitoring of U.S. check outs (Bona Fide Residency Test for FEIE). "It's something that individuals need to be truly thorough regarding," he states, and suggests expats to be cautious of common errors, such as overstaying in the U.S.

The Only Guide to Feie Calculator

tax obligation responsibilities. "The reason U.S. taxes on worldwide income is such a huge offer is because several people neglect they're still based on U.S. tax also after moving." The united state is one of the couple of nations that taxes its residents despite where they live, implying that even if an expat has no income from U.S.

income tax return. "The Foreign Tax Credit allows people operating in high-tax nations like the UK to counter their united state tax obligation responsibility by the amount they have actually already paid in tax obligations abroad," claims Lewis. This ensures that deportees are not exhausted twice on the same revenue. Those in reduced- or no-tax nations, such as the UAE or Singapore, face added obstacles.

Feie Calculator for Beginners

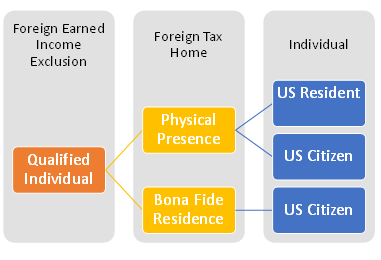

Below are several of the most frequently asked concerns regarding the FEIE and various other exemptions The International Earned Income Exemption (FEIE) allows U.S. taxpayers to exclude up to $130,000 of foreign-earned earnings from government income tax, minimizing their U.S. tax obligation. To certify for FEIE, you need to meet either the Physical Existence Examination (330 days abroad) or the Authentic House Examination (verify your main home in a foreign country for an entire tax obligation year).

The Physical Existence Examination needs you to be outside the U.S. for 330 days within a 12-month period. The Physical Presence Test likewise requires U.S. taxpayers to have both a foreign revenue and an international tax home. A tax home is specified as your prime area for company or employment, despite your household's house.

The Basic Principles Of Feie Calculator

A revenue tax treaty in between the united state and one more country can aid protect against dual tax. While the Foreign Earned Earnings Exclusion minimizes taxable revenue, a treaty might give fringe benefits for eligible taxpayers abroad. FBAR (Foreign Financial Institution Account Record) is a required declare united state people with over $10,000 in international monetary accounts.

Qualification for FEIE depends on conference certain residency or physical visibility examinations. He has over thirty years of experience and now specializes in CFO services, equity compensation, copyright taxes, marijuana taxes and separation associated tax/financial planning matters. He is an expat based in Mexico.

The international gained earnings exclusions, often referred to as the Sec. 911 exclusions, leave out tax obligation on salaries earned from working abroad. The exclusions make up 2 components - a revenue exemption and a real estate exclusion. The adhering to Frequently asked questions review the advantage of the exemptions consisting of when both partners are expats in a basic way.

Unknown Facts About Feie Calculator

The tax benefit omits the revenue from tax at bottom tax prices. Previously, the exemptions "came off the top" decreasing revenue subject to tax at the leading tax obligation rates.

These exclusions do not excuse the incomes from United States taxes but merely provide a tax reduction. Note that a single person functioning abroad for every one of 2025 that gained about $145,000 with no other income will have gross income reduced to no - successfully the very same solution as being "free of tax." The exemptions are computed every day.